Capital Management

Efficiently gather and manage investor and board information in a digital format,

while also generating comprehensive KYC reports and credit assessments for enhanced decision-making.

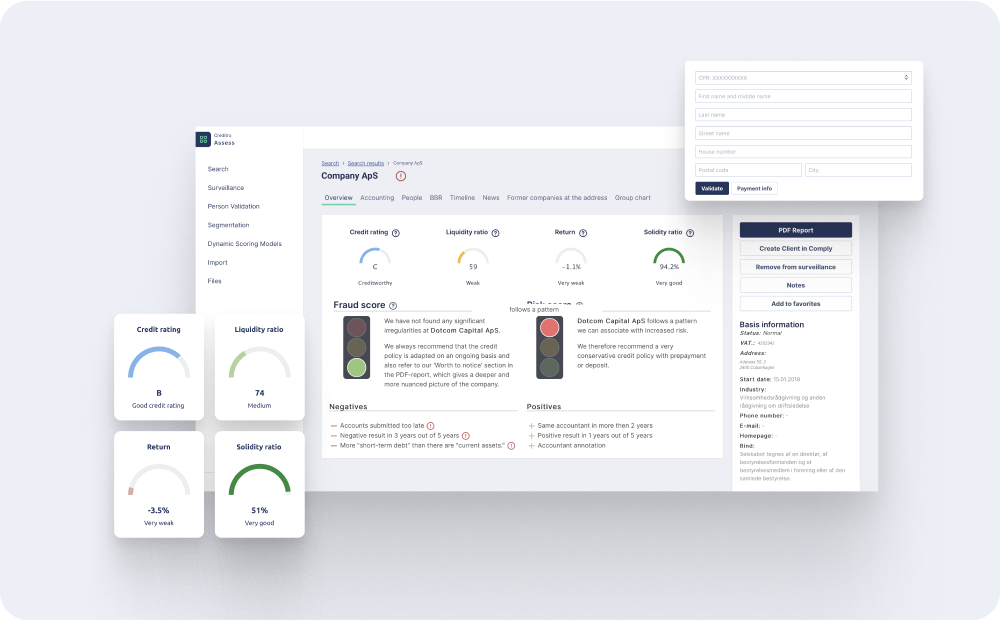

Creditro Assess

Automatic credit assessment and bankruptcy notification

Make informed decisions and be notified of bad payers, bankruptcies and fraudulent companies and avoid losses, debt collection and wasted work hours.

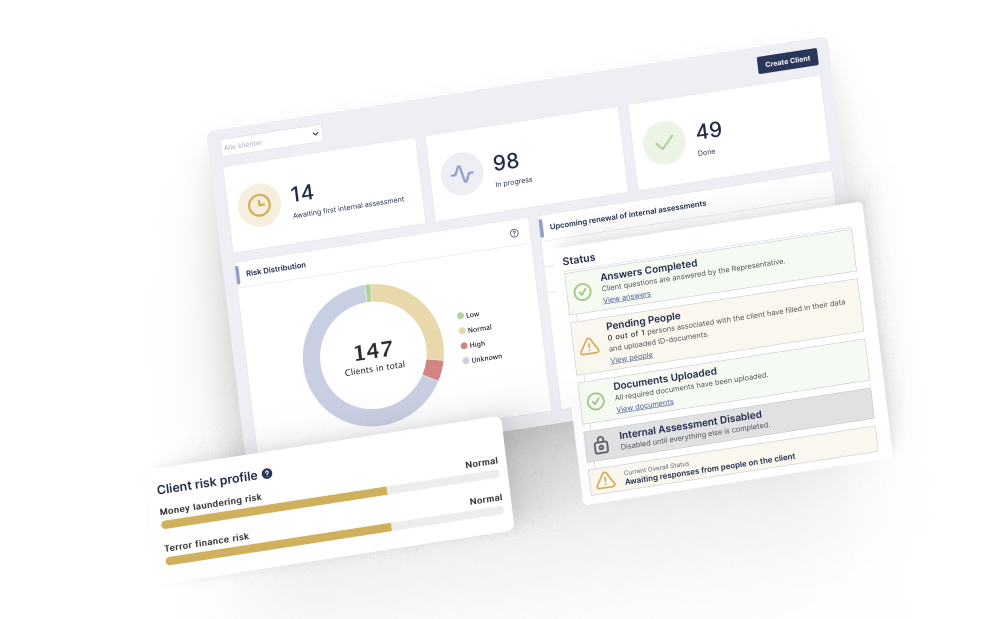

Creditro Comply

KYC Compliance made fast, secure and systematic

Everything gathered on a clear and user-friendly platform. Documentation always in accordance with applicable legislation.

In full compliance

Creditro Comply with ease and security. Receive necessary data, meet AML-legislation, and combat fraud with our real-time cloud-based technology.

Reduce time used by 95%

Save time with Creditro Comply's automation of KYC processes. An average check takes only 5 minutes, giving you more time for your customers.

Simple and intuitive

Simplify your KYC & AML compliance process with our user-friendly platform. User-friendly journey, one dashboard, live support, and integrations with numerous solutions.

Save more time with

Creditro's innovative automation software

Our software is designed to facilitate your everyday life and make it easier for you to do your work in Capital Management.

KYC

Automate your KYC checks

As a financial company, you are subject to a wide range of strict legislation. You must comply with anti-money laundering (AML) legislation, which is frequently updated or changed. In order to comply with the Money Laundering Act, many companies have adapted labor-intensive workflows that can be opaque with rich documentation. The KYC check of new customers in particular is often very resource-intensive due to the required information and documentation. The information must be continuously monitored for validation and expiration.

Creditro is a digital platform aimed at your needs. We have automated the slow manual workflows so that you can better optimize your time for fast and agile onboarding of new customers.

Fraud screening

Be up-to-date on the current legislation

As a financial company, you must always be well equipped to detect fraud. With Creditro, your ability to detect and screen for financial crime will grow more effectively. Our intelligent tools never sleep; they provide constant real-time, in-depth knowledge and an overview of your customers.

Creditro is always up to date with the applicable legislation, so you can be sure that your company remains compliant. But most importantly, you will be better equipped to stop and prevent fraud and financial crime.

Automatic workflow

Improved customer experience with automated workflows

With our compliance platform, you can save up to 75% of the manual workload associated with KYC-related tasks.

In short, we put your clients through an automatic KYC check and set up rules and variables to discover which clients can be automatically approved and which clients need further investigation. We can also integrate your anti-money laundering rules and policies into our intelligent software, which, among many other things, ensures that you have a consistent baseline when meeting with your customers.

Fast and agile processes also mean a more intuitive and better experience for your clients.

Digital signing & document storage

Digital signing improves the customer experience

Forget papers and insecure digital channels. We offer digital signing that lets your customers sign anywhere and anytime - securely. This is an advantage for both you and your clients.

With Creditro, we also offer document storage so you don't have to scan and send your documentation repeatedly.

Let's find the right

solution for you!

Creditro helps businesses save time on demanding KYC/AML processes. Book a demo where we will walk you through our solution tailored to your company and its specific needs.