Creditro Assess

Minimise financial risks with

automated credit assessments

Instant and precise credit assessments help you make informed decisions, so you avoid unnecessary risks and wasted work hours..

Our clients conduct over +15.000 monthly KYC checks with Creditro

Avoid giving credit

to the wrong person

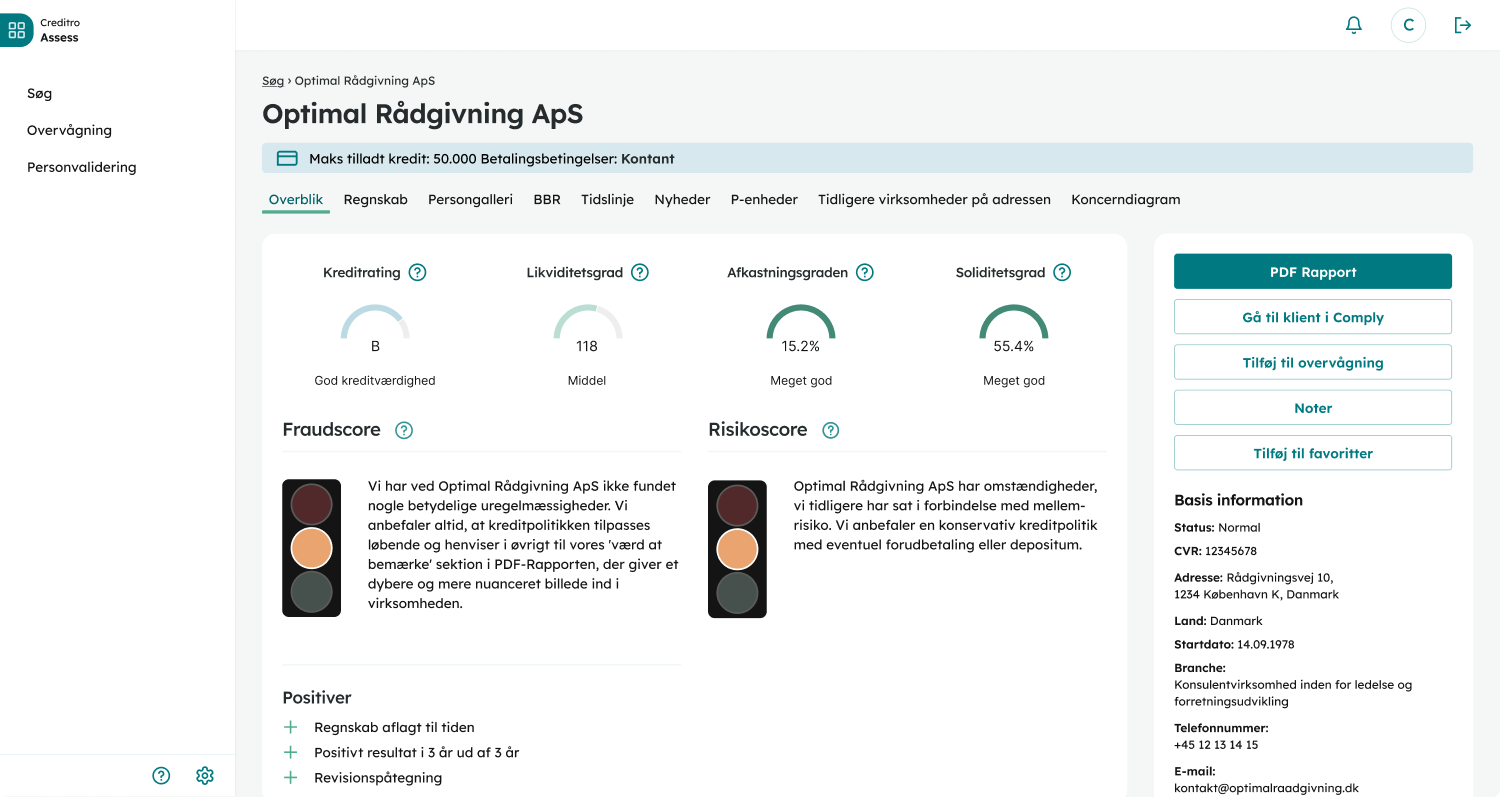

Implement you credit policy and internal scoring models, to ensure that each and every customer lives up to your requirements and standards.

.png?width=867&height=751&name=image%20(1).png)

Spot and act on

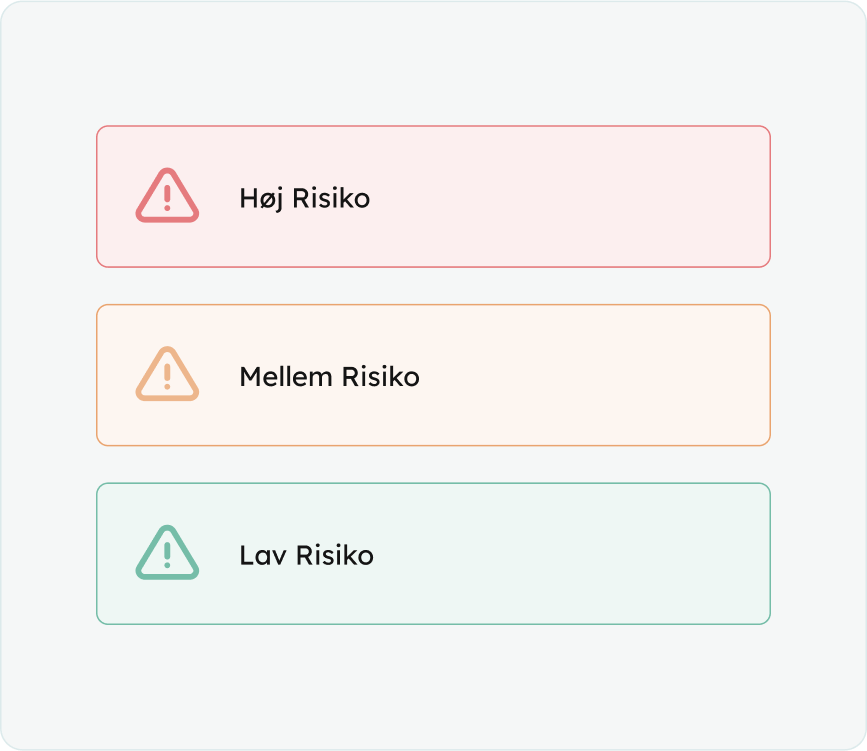

potential risk profiles

Gain insight into your customers and see an assessment of their risk profilesv with our data-based fraud and risk scores.

Features

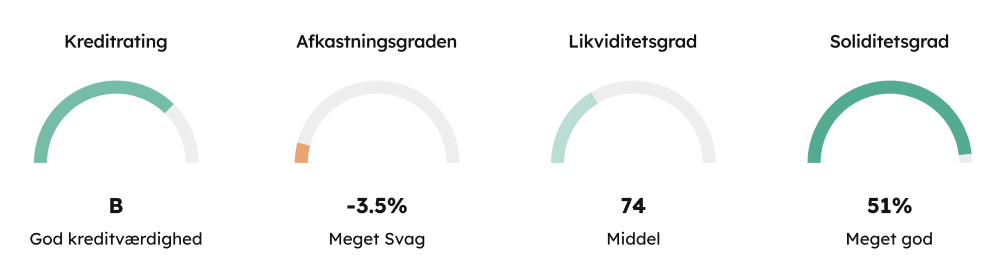

Simple overview of companies' key data

Raw data is converted to clear information, so you have a full overview.

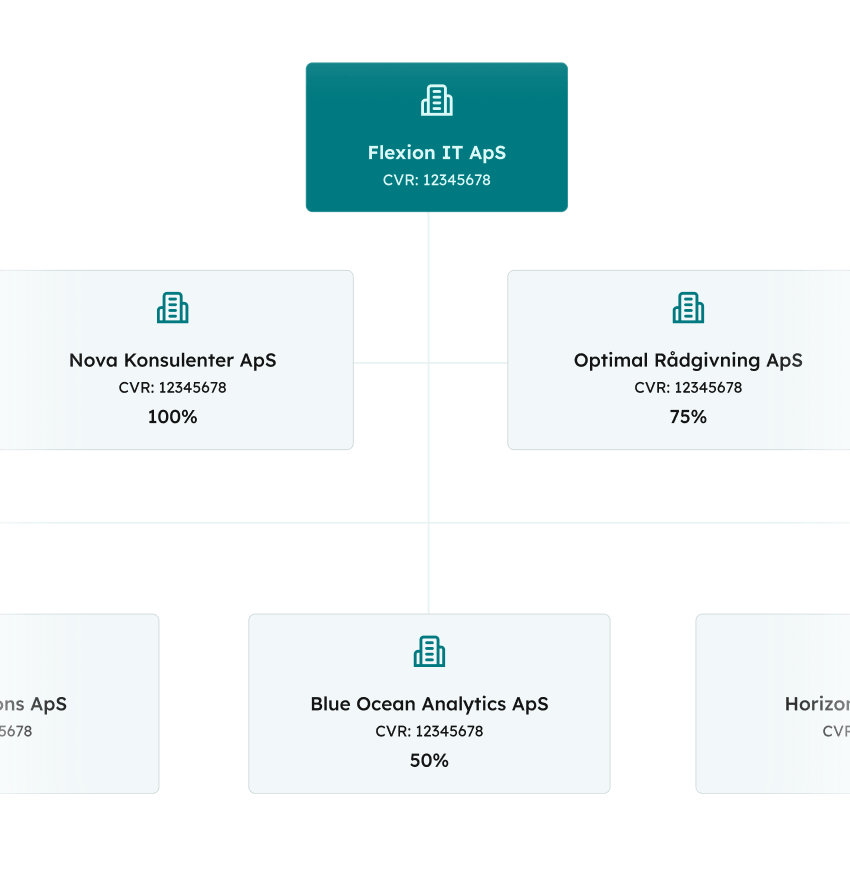

Gain insight into company ownership

Organisational charts provides you with insight into the company structure.

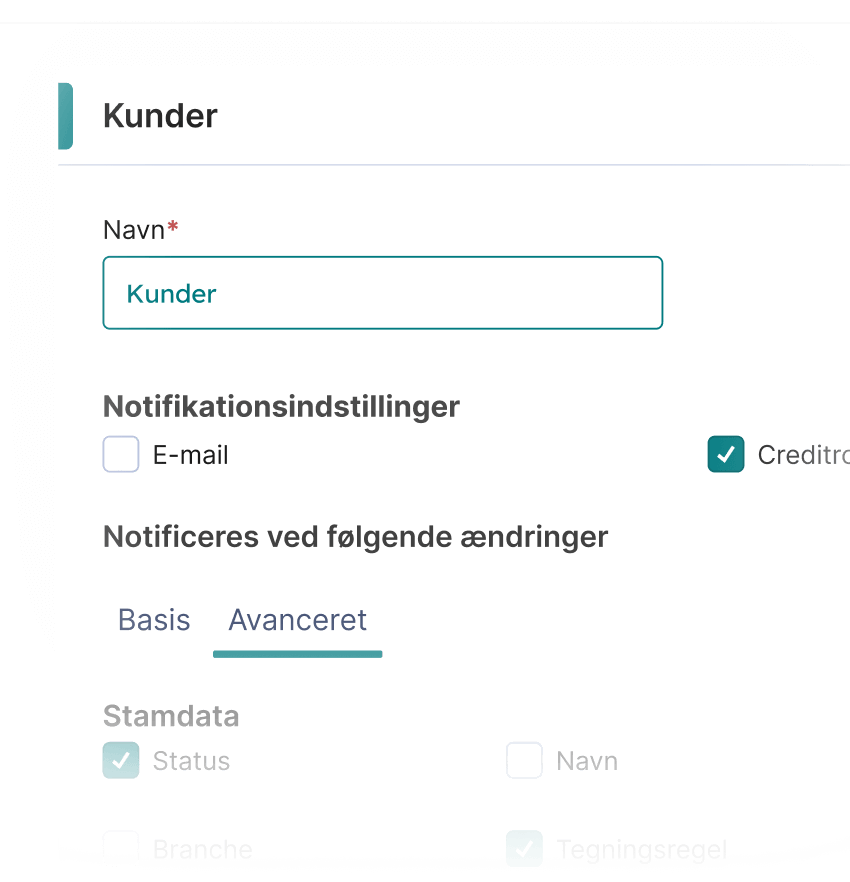

Get ahead with surveillance lists

Continuous monitoring informs you of any changes to the status, finances and other factors.

Download extensive PDF-reports

Generated in real-time, with the most up-to-date information.

All features in Creditro Assess

Adapted to dynamic score models

PDF-report for compiled information

Display of company's key numbers

Indicative risk assessment

Ownership: Who owns what?

Organisational chart

Validation of CPR & RKI Check

Focused search of companies

Import company resgisters

Fraud and risk score

Drag-and-drop interface

ISAE-3000 Certification

Creditro Assess

See our pricing and get started

with Creditro Assess today

The automated way to smarter credit assessments

Creditro Assess

The automated way to smarter credit assessments

2.650,-

Per user per year.

DKK excl. VAT/year.

Automated credit assessments that free up time and resources

One access point for information – covers all of Scandinavia + United Kingdom & Finland.

Daily notifications

Information in real-time - no delays

Predictive analyses, so you are always at the forefront of efforts against loss and fraud

Easy setup of own credit policies and internal score models

Get complete overview over the ownerships in your portfolio with our built-in organisational chart

Support by phone, mail and chat

Frequently asked questions

You can find the answers for some of our most frequently asked questions right here.

-

What is a credit assessment?

An assessment of a debtor's creditworthiness, which can be an individual, company, public authority, or other entity, is called a credit rating.

Credit ratings influence a person’s/company’s/industry’s ability to obtain credit and the terms (interest rates, etc.) that lenders may offer. It is crucial for the health of your credit. -

What is a risk assessment?

The purpose of a risk assessment is to identify risks that could negatively impact a company's business operations. This process involves identifying inherent risks within the industry and providing measures, procedures, and controls to help the organisation mitigate the impact of such risks.

With Creditro Assess, you receive a single assessment point for real-time information.

-

How do I detect fraud?

Almost all companies will be affected by fraud, to some extent. Common questions that arise after experiencing fraud include: who was responsible and whether it could have been anticipated. A study highlights some of the most prominent characteristics of a fraudster:

- Aged between 36 and 45

- Employed in a trusted position (29% are Directors)

- Have been with the company for more than six years

The study also reveals that in over half of the cases, the fraudster works within the same company that is targeted, and in about 70% of the cases, they do not act alone in the fraud.

With our early warnings about bankruptcies, you can act in advance and minimise your losses. Our customers receive alerts every day in their inbox or through their ERP/CRM systems.

Creditro Assess provides you with automatic credit assessments across countries. We perform risk calculations and alert you about bad payers, bankruptcy alarms, and fraud detection.

We have built an intelligent platform that can:

- Identify 9 out of 10 fraudulent companies*

- Warn against 65% of all bankruptcies at least 3 months before they occur **

* Based on 5,249 bankruptcies in Denmark in the years 2018-2019

** Based on 952 companies convicted of fraud. -

What does a risk score assess?

Creditros risk score evaluates the company's internal conditions, and simultaneously the likelihood of bankruptcy. The algorithm examines both internal circumstances and external factors related to the company and the individuals behind it. The analysis utilises bankruptcy statistics dating back over 60 years.

-

What is a fraud score?

A fraud score indicates the extent to which a company follows a pattern we have previously associated with fraudulent and shell company activities. However, we always recommend using common sense and maintaining a conservative credit policy.

Let us simplify your

AML compliance

Compliance is tedious, but necessary. We help you through the tricky landscape in a simple and effective way, so you have time for other valuable tasks.