Creditro Comply

A safe and efficient way

to Know Your Customer

Quick client creation and document collection,

in one platform that gives you instant overview.

+1200 companies automate their KYC with Creditro

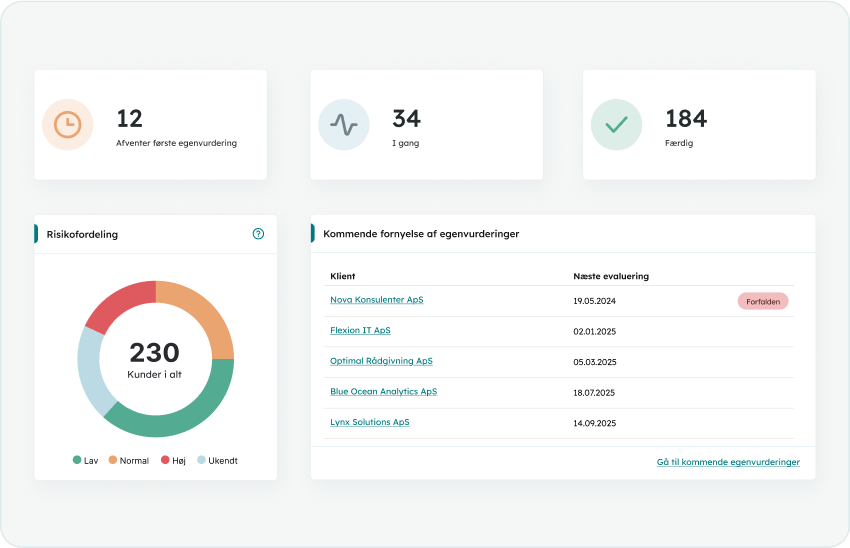

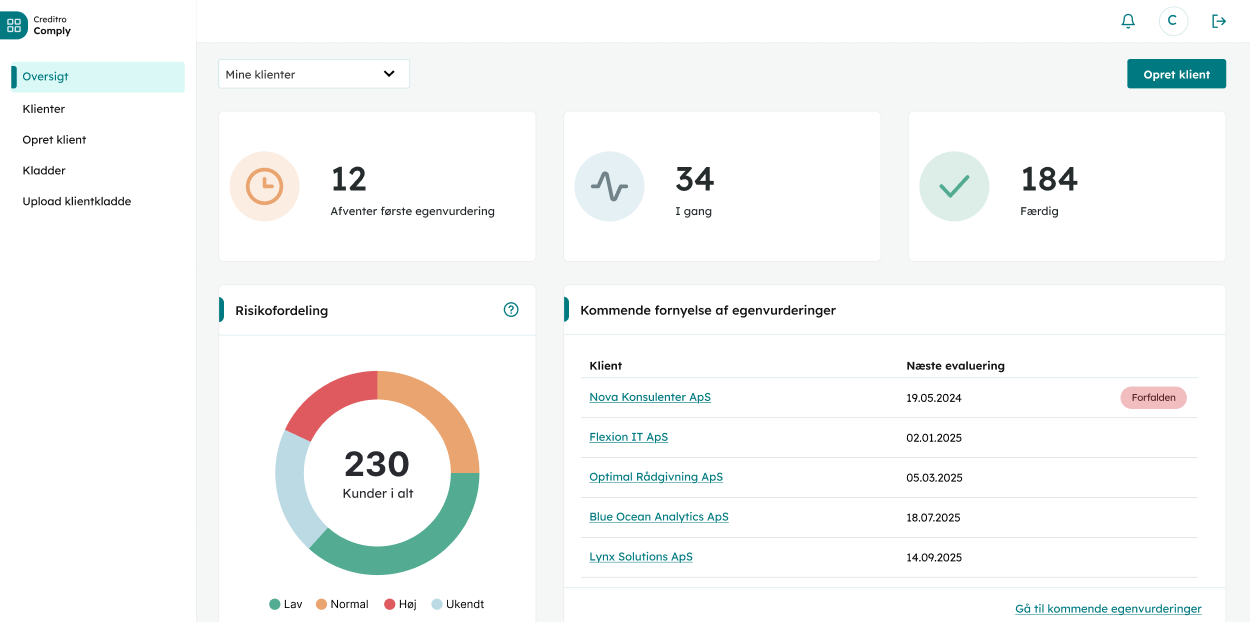

The full overview

at your fingertips

Your dashboard provides the status of your clients and gives you an overview of cases that lack documentation or final assessment. The automated overview helps you take action, when and where it's needed.

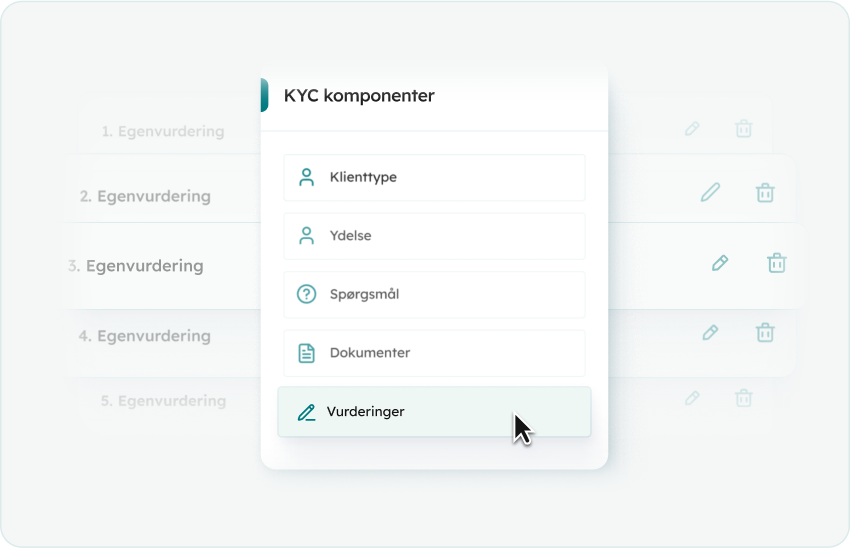

A platform that adapts

to your workflows

Creditro Comply har a standard setup, which is based on our in-depth knowledge and insights from other users. The platform can always be adapted to best fit the way you and your team work with KYC compliance.

Collaborate on your

case work

From creating a client to the final assessment, everyone has an overview of and access to the same information, allowing you to share the compliance task across teams and roles in your company.

Start collecting documentation in just a few minutes

Achieve KYC compliance

in 3 simple steps

Try the simple process in Creditro Comply

The easiest way through KYC for you and your clients

Try it hereSTEP 1

Create client

Onboard a new client by choosing their customer type and service, and enter their master data.

STEP 2

Collection of information

Your client submits answers to a questionnaire, along with their ID documentation. The platform automatically reminds them of missing information, and ensures safe data storage.

STEP 3

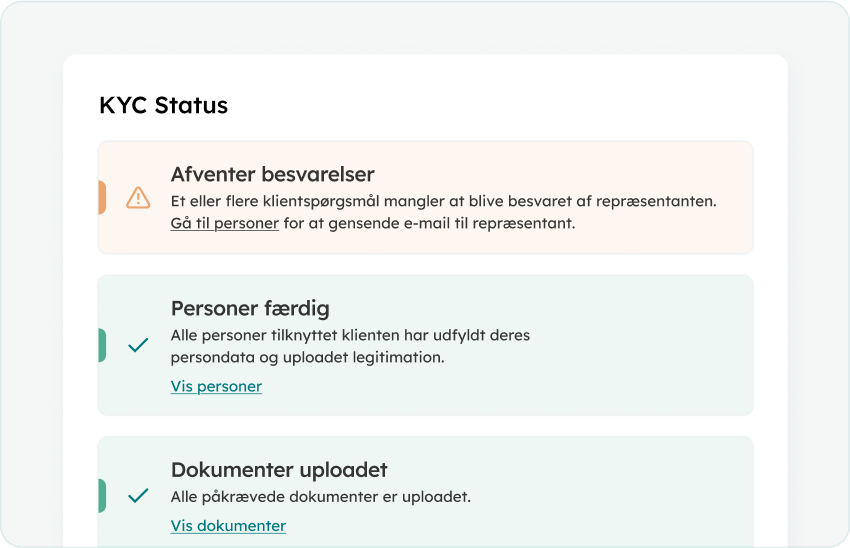

Risk assessment

Our system provides an indicative risk assessment, which helps to identify and warn about potential risks, such as fraud, terror financing or bankruptcy. After this, you set your final assessment.

Updating & monitoring

You can aks follow-up questions, and continuously renew the information. We ensure that data is updated in realtime and notify you if there are any changes.

Features

Creditro Comply offers a flexible setup that can be customised to fit your workflows. Regardless of your needs, all features are available to you.

A clear and simple overview

Our dashboard provides insight intro you client status, and eases your compliance efforts.

Verify with eID

Your clients can log in and verify with their responses eID.

KYC-Report

View the status of your KYC checks and spot any action points.

Activity timeline

Documentation of all client activities is important for your compliance.

All features on the platform

Creditro Comply eases you KYC process and we have put several features together to help you all the way to AML compliance.

Notification upon client changes

Validation of data & ID documents

Automatic PEP, RCA & sanctions check

Indicative risk assessment

Identifying benificial owners

Dynamic questionnaire

Advanced security

Organisational diagram

ISAE-3000 certification

Multi-factor approval

"Compliance is a continuous process,

which constantly evolves"

With changing legislations, latest interpretations and new practices, there are big demands to meet when working with compliance. This counts not just for employees, but also for the tools and systems in place.

Creditro is here

to make your life easier

I highly recommend Creditro, if you are a law firm who is looking for an effective and reassuring system to manage AML compliance.

Head of KYC Compliance, Njord Law Firm

We have made a lot of improvements in our compliance work. A bonus is, the great credit reports on our customers that we can use internally.

Accountant/Director, ADMK

Creditro Comply

See our prices and get started with Creditro Comply today

Creditro Comply is for anyone working with AML compliance,

regardless of how big the clientbase is. Find the right solution for you.

Comply 10

For companies with 10 or fewer clients

1.895,-

DKK excl. VAT/year

Up to 10 clients

1 user included

Dynamic questionnaire

PEP, RCA, and Sanctions check

PDF Downloads

Indicative risk assessment

Comply 30

For companies with 30 or fewer clients

4.805,-

DKK excl. VAT/year

Up to 30 clients

1 user included

Dynamic questionnaire

PEP, RCA, and Sanctions check

PDF Downloads

Indicative risk assessment

Comply 50

For companies with 50 or fewer clients

6.925,-

DKK excl. VAT/year

Up to 50 clients

1 user included

Dynamic questionnaire

PEP, RCA, and Sanctions check

PDF Downloads

Indicative risk assessment

Comply 50+

For companies with +50 clients

Contact Sales

Contact Sales for pricing

More than +50 clients

2 users included

Dynamic questionnaire

PEP, RCA, and Sanctions check

PDF Downloads

Indicative risk assessment

We have the solution for your industry

We have partnerships across several industries, which gives us unique insight into the ideal AML compliance setup.

Let us simplify your

AML compliance

Compliance is tedious, but necessary. We help you through the tricky landscape in a simple and effective way, so you have time for other valuable tasks.

-1.png)