AML compliance for

Law Firms, which frees up time for legal counselling

Our solution is customisable to fit your workflows and automate the parts of AML compliance, that take up most of your time.

Our clients conduct over +15.000 monthly KYC checks with Creditro

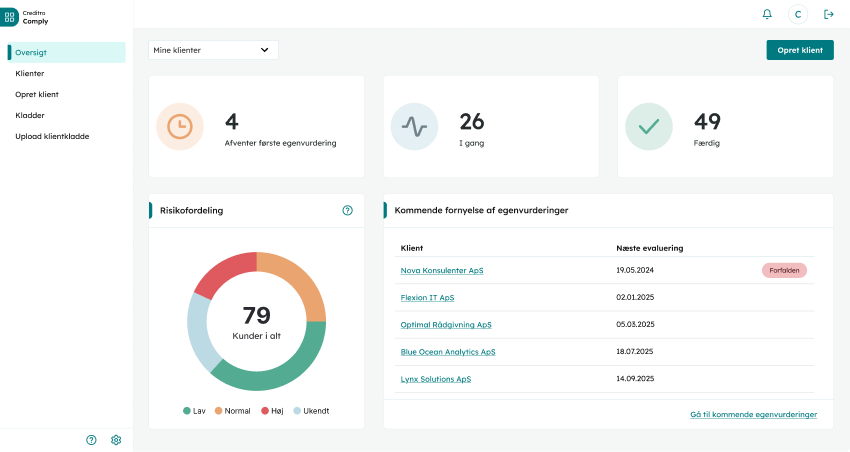

Complete overview for efficient workflows

If you want to split case work – for example between an Attorney and secretary – our platform is ideal for collaboration. From client creation, to making your final assessment, everyone has access to all information.

Assessments for all case types and services

If you manage different case types or services for a client, you won't have to send them through multiple KYC processes. You simply conduct several assessments per client, whilst keeping all the documentation history at hand.

Compliance takes time, so we'll pause it for you

Dedicate the necessary time and attention to an assessment in Creditro Comply. When assigning multiple people to a case, everyone can access and save drafts, ensuring all documentation is throughly evaluated.

Integrations for your

legal software setup

UNIK

Create a case in Advosys and continue your work in Creditro Comply with ease and efficiency.

Legis 365

Full KYC integration for a hassle-free workflow. Easy administration and case management in Legis 365.

Partnerships

in your industry

"Compliance is a continuous process,

which constantly evolves"

With changing legislations, latest interpretations and new practices, there are big demands to meet when working with compliance. This counts not just for employees, but also for the tools and systems in place.

Creditro Consultancy

Customised consulting, that helps with your documentation

Understanding the legislation thoroughly is essential to fully address AML compliance. With our guidance, the best processes for your company are established, ensuring your documentation package is completely in order.

Support & Client Management

All the help you

need, in one spot

We prioritise providing excellent support and take pride in the relationships we have built with our clients. Our extensive experience ensures that we are keenly aware of your specific needs and challenges.

Personal onboarding & advice

Get started with a Client Partner, who helps you setup and adapt the platform.

Technical support

We are standing by the phones and can help you with all kinds of questions.

AML compliance best practices

The best procedures for your company, is something we figure out together.

Creditro’s suite of software tools is your easy button for AML compliance

Creditro is here

to make your life easier

I highly recommend Creditro, if you are a law firm who is looking for an effective and reassuring system to manage AML compliance.

Head of KYC Compliance, Njord Law Firm

We have made a lot of improvements in our compliance work. A bonus is, the great credit reports on our customers that we can use internally.

Accountant/Director, ADMK

Let us simplify your

AML compliance

Compliance is tedious, but necessary. We help you through the tricky landscape in a simple and effective way, so you have time for other valuable tasks.