AML compliance

for Financial Institutions

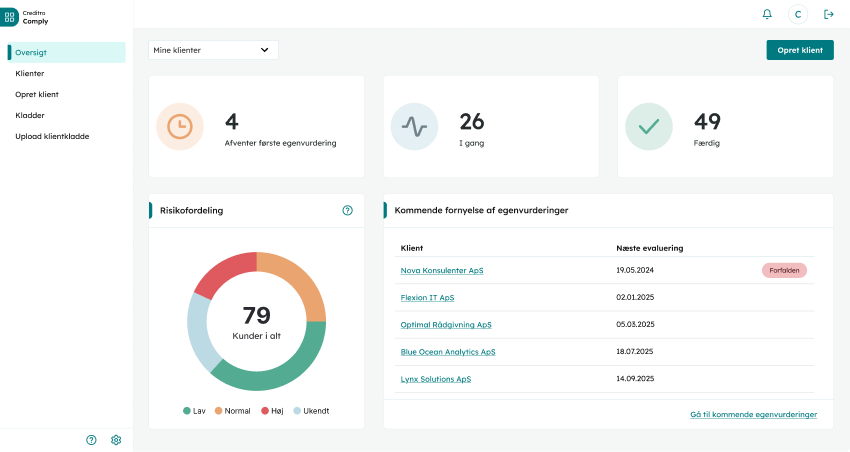

With Creditro Comply and Creditro Assess you have the best foundation for making informed decisions and complying with legislation.

Our clients conduct over +15.000 monthly KYC checks with Creditro

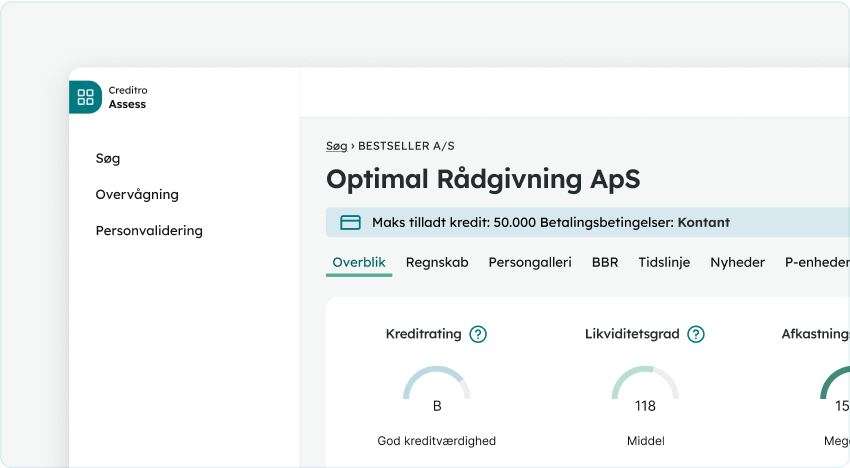

Assess gives financial insight and records

With the Assess module, you get an organisational chart and a historical overview of a company and its beneficial owners, providing you with the best foundation to understand your overall financial risks.

Safe storage of ID and documentation

It is essential for your customer relationships that personal data is collected and stored safely. Our ISAE 3000 statement, certifies that personal data is processed in compliance with GDPR.

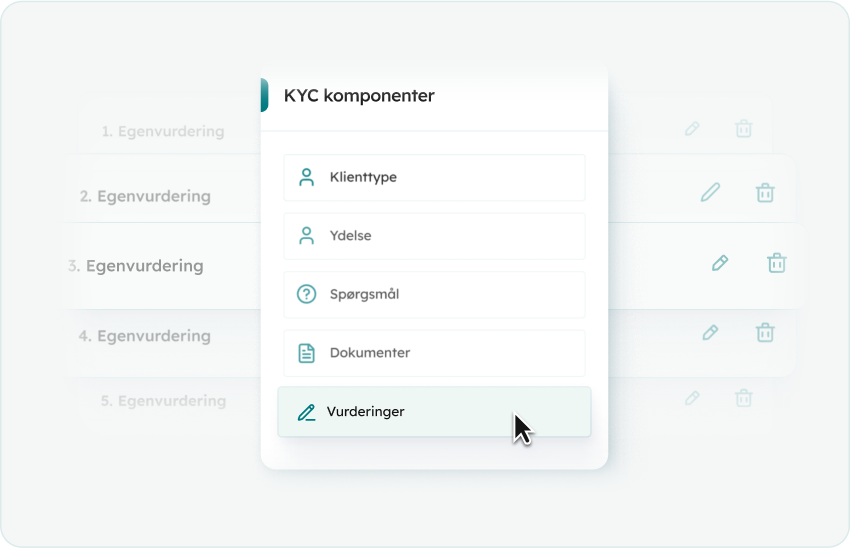

Custom assessments and questionnaires

Our standard setup can be customised to align with your client types and your way of working. This makes your data collection efficient, and ensures that you fully achieve your compliance objectives.

Active users

Monthly KYC checks

Customers

Creditro Consultancy

Customised consulting, that helps with your documentation

Understanding the legislation thoroughly is essential to fully address AML compliance. With our guidance, the best processes for your company are established, ensuring your documentation package is completely in order.

Support & Client Management

All the help you need, in one spot

We prioritise providing excellent support and take pride in the relationships we have built with our clients. Our extensive experience ensures that we are keenly aware of your specific needs and challenges.

Personal onboarding & advice

Get started with a Client Partner, who helps you setup and adapt the platform.

Technical support

We are standing by the phones and can help you with all kinds of questions.

Guidance on processes

If you have questions about your workflows, we can happily share our insights with you.

Creditro’s suite of software tools is your easy button for AML compliance

Creditro is here

to make your life easier

I highly recommend Creditro, if you are a law firm who is looking for an effective and reassuring system to manage AML compliance.

Head of KYC Compliance, Njord Law Firm

We have made a lot of improvements in our compliance work. A bonus is, the great credit reports on our customers that we can use internally.

Accountant/Director, ADMK

Let us simplify your

AML compliance

Compliance is tedious, but necessary. We help you through the tricky landscape in a simple and effective way, so you have time for other valuable tasks.