Creditro Comply

En sikker og effektiv vej

til kundekendskab

Hurtig klientoprettelse og dokumentindsamling,

på en platform der giver dig hurtigt overblik.

Få en fornemmelse af Creditro Comply med vores interaktive demo

Vores kunder laver mere end +15.000 månedlige KYC tjek med Creditro

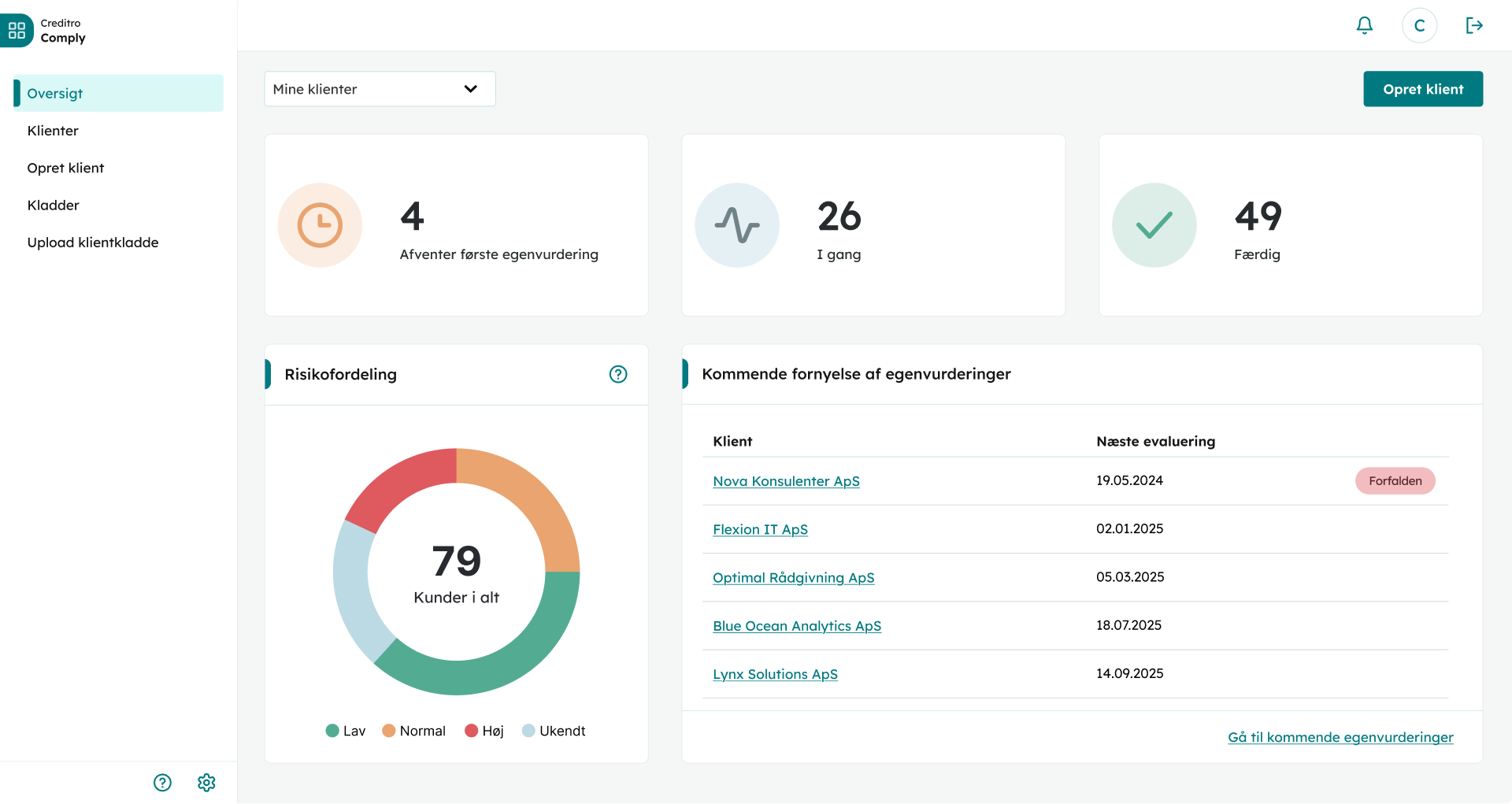

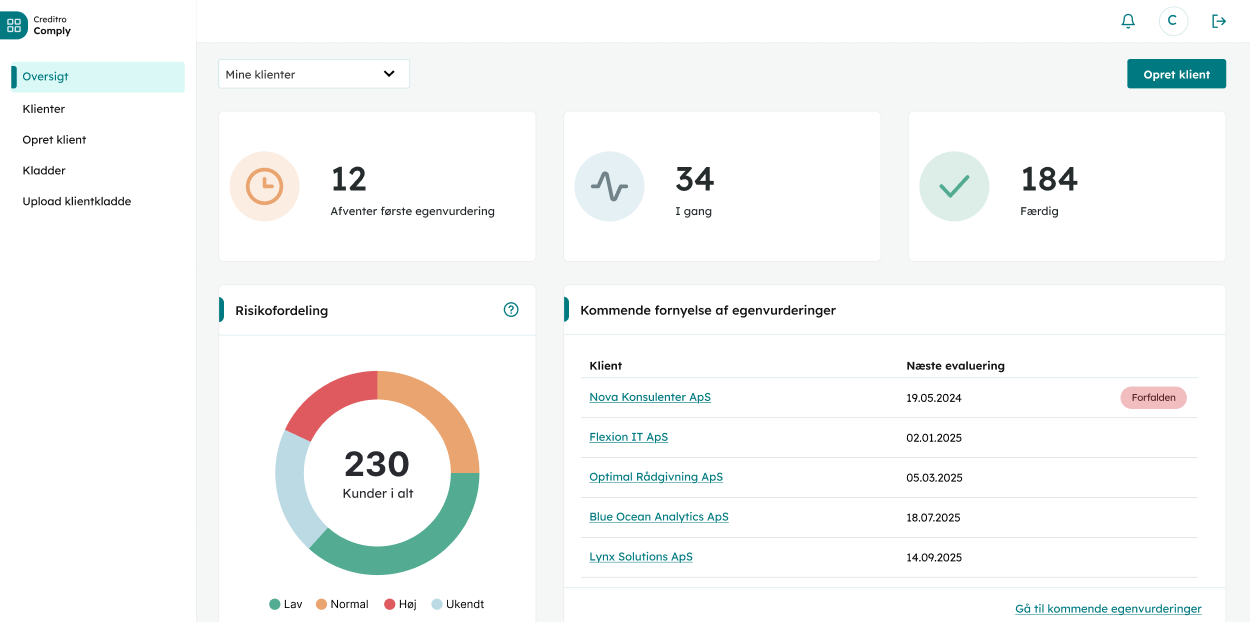

Det fulde overblik

er lige ved hånden

Dit dashboard viser status på dine klienter og giver dig overblik over sager der mangler dokumentation eller egenvurdering. Det automatiserede overblik, hjælper dig med at se hvor du skal tage handling.

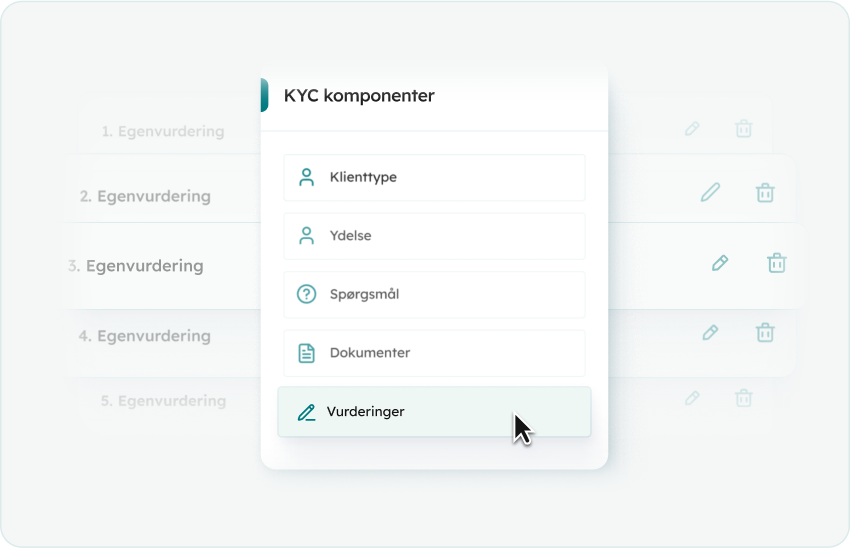

Systemet tilpasses

dine arbejdsgange

Når du bliver bruger på Creditro Comply er der et standard setup, baseret på vores indsigt fra andre kunder, men det kan til enhver tid rettes til, så det passer til den måde du og dit team bedst arbejder på.

Samarbejde i jeres sagsbehandling

Fra oprettelse af klient og helt frem til den afsluttende vurdering, har alle overblik over og adgang til den samme information, så I nemt kan dele compliance opgaven på tværs af teams og roller i jeres virksomhed.

Start din dokumentationsindsamling på få minutter

Nå i mål med KYC

på blot 3 simple trin

Afprøv den simple proces i Creditro Comply

Gør KYC nemt – for både dig og dine klienter

Start interaktiv demoTRIN 1

Opret kunde

Onboard en ny kunde ved at vælge den rette kundetype og service, og indtast deres stamdata.

TRIN 2

Informationsindsamling

Kunde indsender ID-dokumentation og svarer på jeres dynamiske spørgeskema. Platformen påminder automatisk om manglende information, og sørger for sikker dataopbevaring.

TRIN 3

Risikovurdering

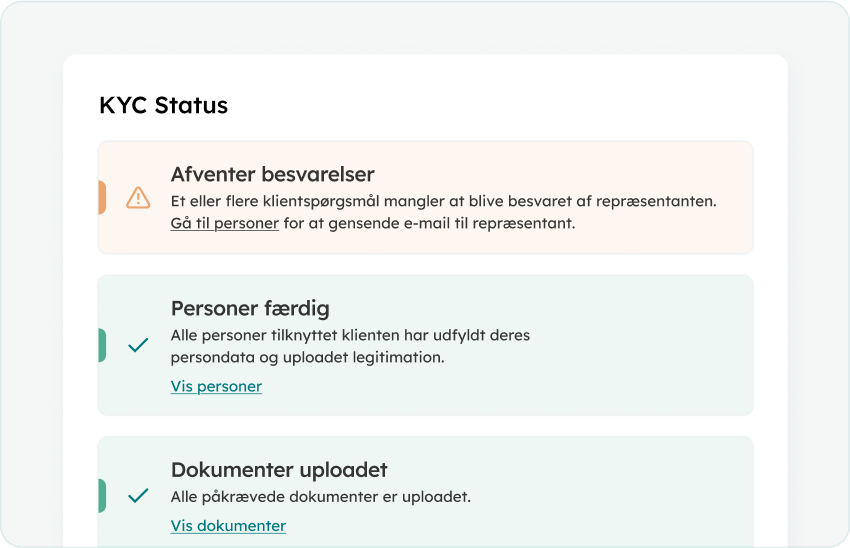

Du får en indikativ risikovurdering, der hjælper dig med at identificere potentielle risici såsom svindel, finansiering af terrorisme eller konkurs. Til sidst foretager du din endelige egenvurdering.

Opdatering & Overvågning

Du kan stille opfølgende spørgsmål til din kunde, og forny informationerne løbende. Vi sørger for, at data er opdateret i realtid og notificerer dig ved ændringer i kundeforholdet.

Funktioner

Creditro Comply har en fleksibel opsætning, som kan tilpasses dine arbejdsgange. Uanset dine behov, har du alle funktioner til rådighed.

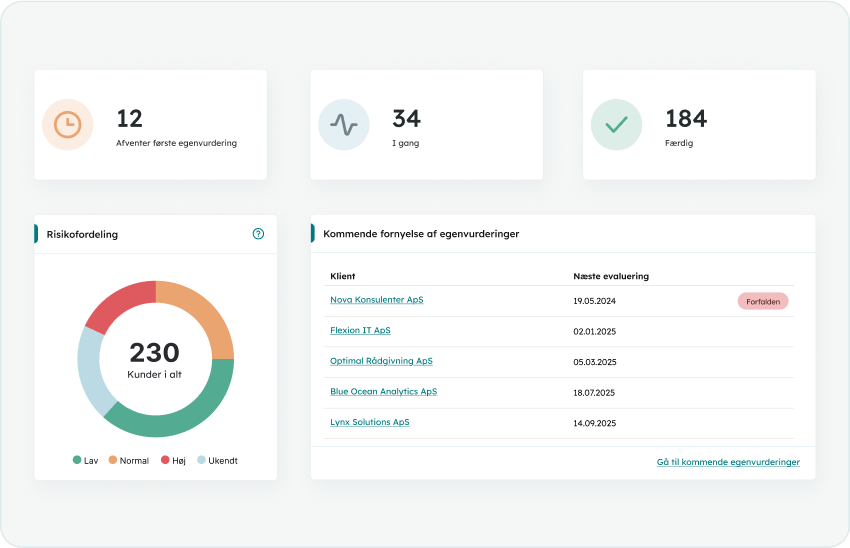

Få et tydeligt

og nemt overblik

Vores dashboard giver indsigt i din klientstatus, og gør din compliance opgave nemmere.

Verificer med eID

Dine klienter kan logge ind og verificere deres svar med eID.

KYC-Rapport

Se status på dine KYC-tjek og få indsigt i, hvad du skal handle på.

Tidslinje over aktiviteter

Dokumentation af al aktivitet på klienter er vigtig for din compliance.

Alle funktioner på platformen

Creditro Comply letter din proces omkring kundekendskab og vi har stykket flere funktioner sammen, til at hjælpe dig helt i mål.

Besked ved kundeændringer

Validering af data & ID dokumenter

Automatisk PEP, RCA & sanktionstjek

Vejledende risikovurdering

Reminder ved udløb af dokumenter

Identificering af Reelle ejere

Dynamisk spørgeskema

Bad media tjek

Avanceret sikkerhed

Koncerndiagram

ISAE-3000 certificering

Multi-faktor godkendelse

"Compliance er en kontinuerlig

proces, der hele tiden udvikles"

Med ny lovgivning, nye fortolkninger og ny praksis, stilles der store krav til arbejdet med compliance. Det er ikke kun gældende for medarbejdere, men også for de værktøjer der implementeres.

Creditro er til for at gøre

dit arbejdsliv meget lettere

Jeg kan stærkt anbefale Creditro, hvis man er et advokatfirma, der ønsker et effektivt og betryggende system til at håndtere AML compliance.

Ansvarlig KYC Compliance, Njord Law Firm

Vi har forbedret meget i vores compliance, og vi har også fået nogle ret fede kreditrapporter om vores kunder til intern brug, så det er en ekstra bonus.

Revisor/Direktør, ADMK

Creditro Comply

Se vores priser og kom i gang

med Creditro Comply i dag

Creditro Comply er for alle der arbejder med KYC compliance,

uanset hvor stor klientbasen er. Find løsningen, der passer til dig.

Comply 10

Til virksomheder med 10 eller færre klienter

1.820,-

DKK ekskl. moms/år

Op til 10 Klienter

1 bruger inkluderet

Dynamisk spørgeskema

PEP, RCA & Sanktionstjek

PDF Downloads

Vejl. risikovurdering

Comply 30

Til virksomheder med 30 eller færre klienter

4.620,-

DKK ekskl. moms/år

Op til 30 Klienter

1 bruger inkluderet

Dynamisk spørgeskema

PEP, RCA & Sanktionstjek

PDF Downloads

Vejl. risikovurdering

Comply 50

Til virksomheder med 30 eller færre klienter

6.660,-

DKK ekskl. moms/år

Op til 50 Klienter

1 bruger inkluderet

Dynamisk spørgeskema

PEP, RCA & Sanktionstjek

PDF Downloads

Vejl. risikovurdering

Comply 50+

Til virksomheder med +50 eller færre klienter

Kontakt salg

Kontakt salg for priser

Mere end 50+ Klienter

2bruger inkluderet

Dynamisk spørgeskema

PEP, RCA & Sanktionstjek

PDF Downloads

Vejl. risikovurdering

Vi har løsningen til din branche

Vi har partnerskaber på tværs af brancher, som giver os unik indsigt i det ideelle hvidvask compliance setup.

Drukner du i hvidvask

compliance opgaver?

Vi hjælper dig ud af dybet, så du kan komme helt i

mål med automatiserede processer.