Hvidvask compliance for Finansielle virksomheder

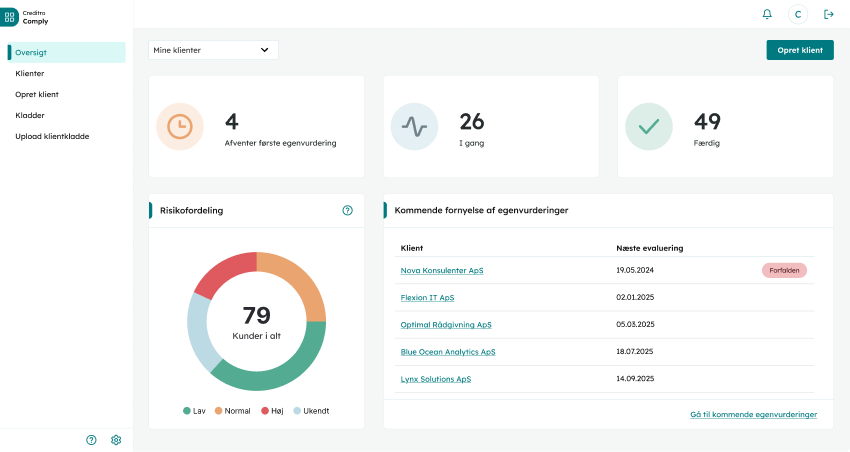

Med Creditro Comply og Creditro Assess får du det bedste grundlag for at kunne træffe informerede beslutninger og efterleve hvidvaskloven.

Vores kunder laver mere end +15.000 månedlige KYC tjek med Creditro

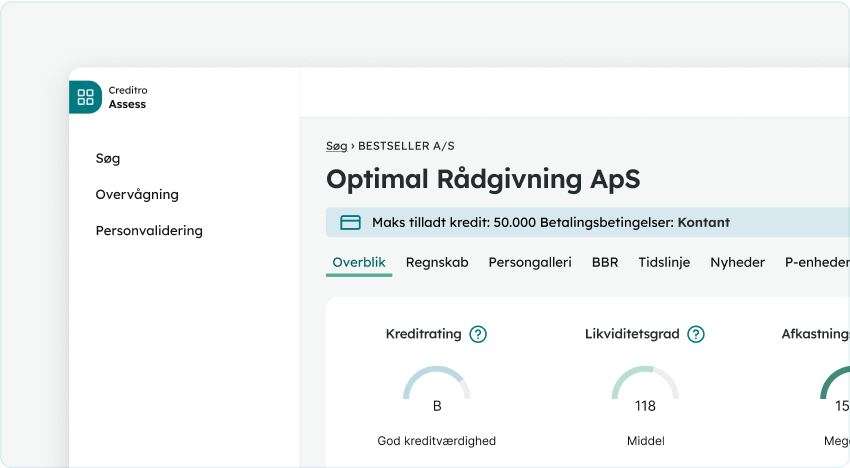

Assess giver økonomisk indblik og historik

Med vores Assess modul får du organisationsdiagram og historisk overblik over virksomheden og dens reelle ejere, og har dermed det bedste grundlag for at forstå din overordnede økonomiske risici.

Sikker opbevaring af

ID & dokumentation

Det er essentielt for dit kundeforhold at persondata indhentes og opbevares sikkert. Vi indhenter årligt en ISAE 3000-erklæring, som er bevis på, at vi tager datasikkerhed alvorligt og behandler data i overensstemmelse med GDPR.

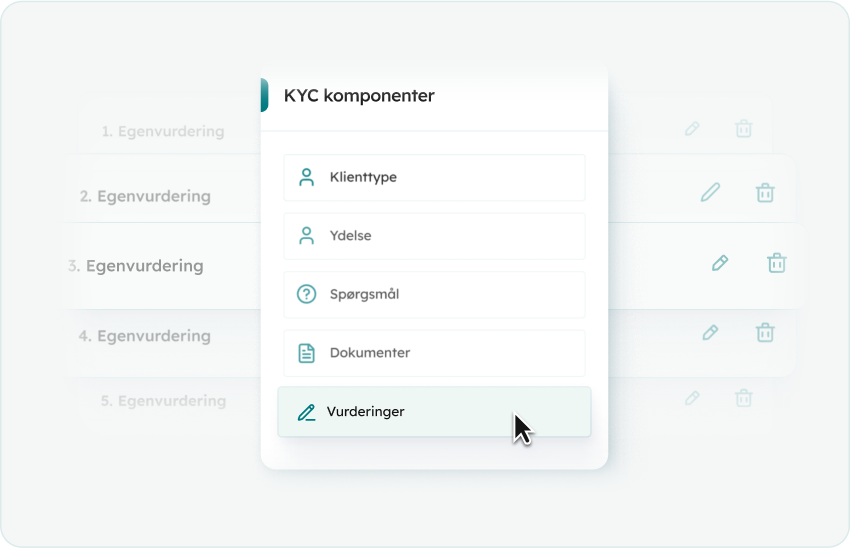

Tilpas egenvurderinger

og spørgeskema

Vores standardopsætning kan tilpasses, så den matcher dine klienttyper og din måde at arbejde på. Det gør din dataindsamling effektiv, så du kommer helt i mål med dit compliance arbejde.

Aktive brugere

Månedlige KYC tjek

Kunder

Creditro Consultancy

Skræddersyet rådgivning, der hjælper dig i mål med din dokumentpakke

Det kræver stor indsigt i lovgivningen, at komme hele vejen rundt om hvidvask compliance. Med vores rådgivning etableres de bedste processer for din virksomhed, så din dokumentpakke er helt på plads.

Support & Client Management

Al den hjælp, du har brug for, samlet på et sted

Vi prioriterer at give en fantastisk rådgivning, og er stolte af de relationer vi har opbygget med vores kunder. Vores store erfaring betyder at vi er skarpe på netop dine behov og udfordringer.

Personlig onboarding & rådgivning

Bliv onboardet af en Client Partner, som også hjælper med evt. komplekse processer.

Teknisk support

Vi er hurtigt klar ved telefonen og hjælper dig med alle slags spørgsmål.

Rådgivning om processer

Hvis du er i tvivl om dine arbejdsgange deler vi gerne vores indsigt med dig.

Med Creditros værktøjer

er hvidvask compliance

bare ét tryk væk

Creditro er til for at gøre

dit arbejdsliv meget lettere

Jeg kan stærkt anbefale Creditro, hvis man er et advokatfirma, der ønsker et effektivt og betryggende system til at håndtere AML compliance.

Ansvarlig KYC Compliance, Njord Law Firm

Vi har forbedret meget i vores compliance, og vi har også fået nogle ret fede kreditrapporter om vores kunder til intern brug, så det er en ekstra bonus.

Revisor/Direktør, ADMK

Lad os simplificere

dit compliance arbejde

Compliance er omstændeligt, men nødvendigt. Vi hjælper dig i mål med opgaven på en simpel og effektiv måde, så du har tid til andre værdifulde opgaver.