3 min read

The gut feeling: an important tool in compliance

Most people working with AML compliance will recognise the feeling when your gut feeling just doesn’t sit right.

Our solution has just had a major upgrade with a function that gives our users the opportunity to further customise templates and questionnaires for their risk assessments, whilst also being able to perform multiple assessments per client.

The thing is, som of our customers need to perform multiple assessments on a case/client, while others work with many different types of cases, which require differentiated templates. In any circumstance, it is essential to document an adequate Know Your Customer procedure and, for that, questionnaires are essential – a feature we have just upgraded significantly.

Several of our customers have requested more flexibility in the risk assessments so they can be adapted to the various needs and circumstances to consider in the KYC procedures. There can be a need to separate assessments for individuals, corporations and smaller companies, along with other customers types. On top of that, there are processes that require more stringent risk assessments, with demands such as followup action or more in-depth documentation .

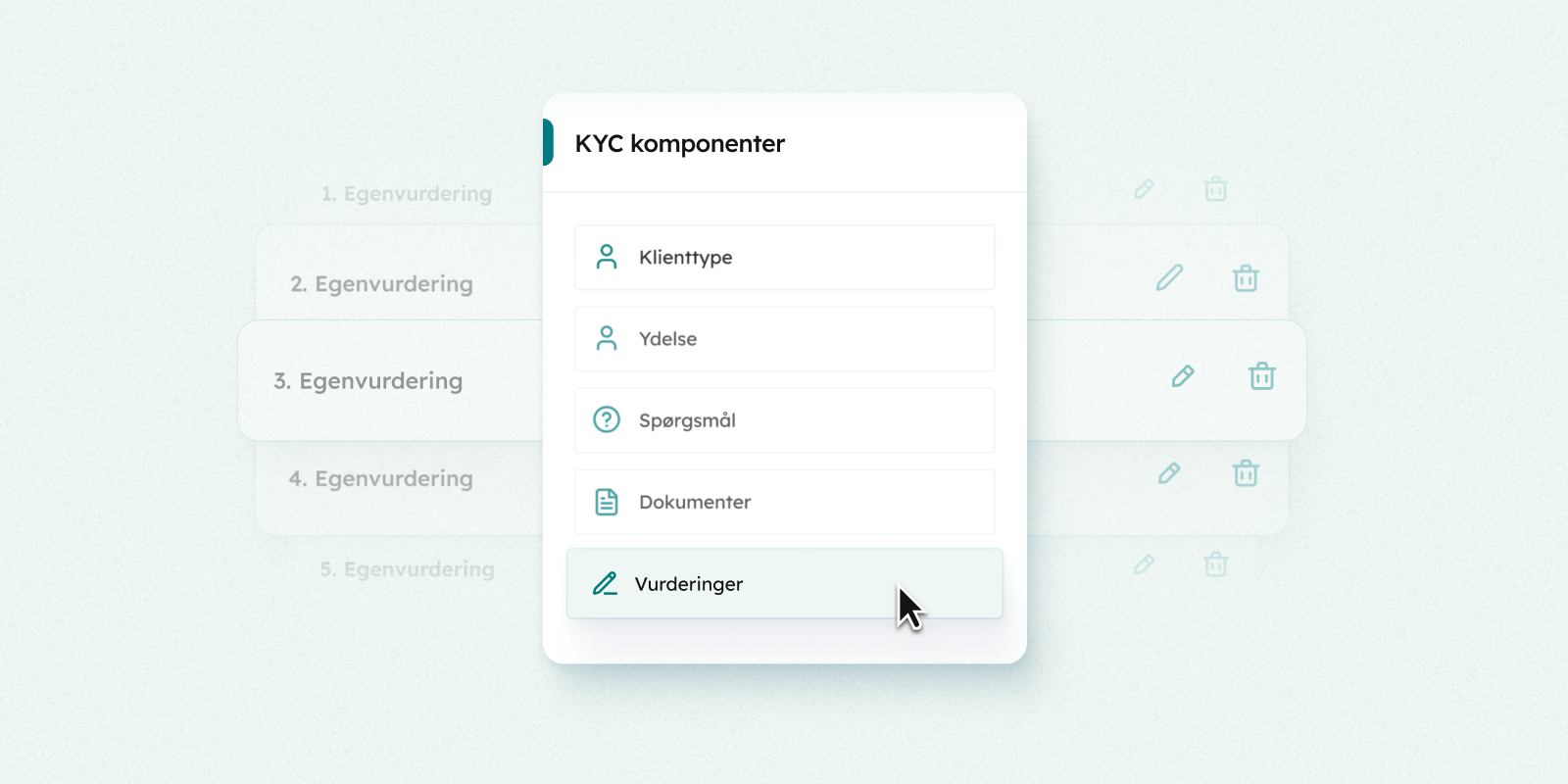

Our new setup allows users to create different templates for their risk assessments, and structure them in multiple ways as well. We have introduced elements such as open text fields and multiple choice for the questionnaire, as well as help texts, example texts, required fields and dependencies. The flexibility of the platform enables the creation of structures that match the internal processes that our customers have already established for their KYC procedures.

When handling a case where there is a basis for more stringent KYC procedures, it is essential to perform a more customised risk assessment. This could, for example, be the case if a customer is identified as a Politically Exposed Person, as this should prompt more questions than a normal procedure would. Those types of follow-up questions can now be worked into the questionnaire of the risk assessments, where a "yes" response to a PEP-question automatically will lead to more questions that the customers needs to answer.

Another example could be for the collection of information about the customers and the beneficial owners, where there country of origin can prove to be significant for the risk assessment. Customers from a different country could mean that there are geopolitical issues at play, which should also be worked into the questionnaire with dependencies.

It is mandatory by law to perform a comprehensive risk assessments, as part of the KYC procedure. The different case and client types pose various risks, which require customised approaches. Our customers already have existing procedures around these concerns and they will now be able to base their risk assessments around their own procedures.

This is a significant improvement in their workflows as they can build templates in line with their processes and precisely define what they need answers to in the internal risk assessment – no matter what type of case or client.

3 min read

Most people working with AML compliance will recognise the feeling when your gut feeling just doesn’t sit right.

2 min read

We are pleased to officially launch Comply Light – a simplified solution designed for lawyers who need to collect and store ID documentation in a...

3 min read

Time is running out if you want to stay ahead of the legislative changes affecting lawyers who use pooled client accounts, which come into force on...