Full AML compliance for Accountants and Bookkeepers in one platform

Our platform framework adapts to your workflows, providing you with an efficient setup, that significantly eases your AML compliance work.

Our clients conduct over +15.000 monthly KYC checks with Creditro

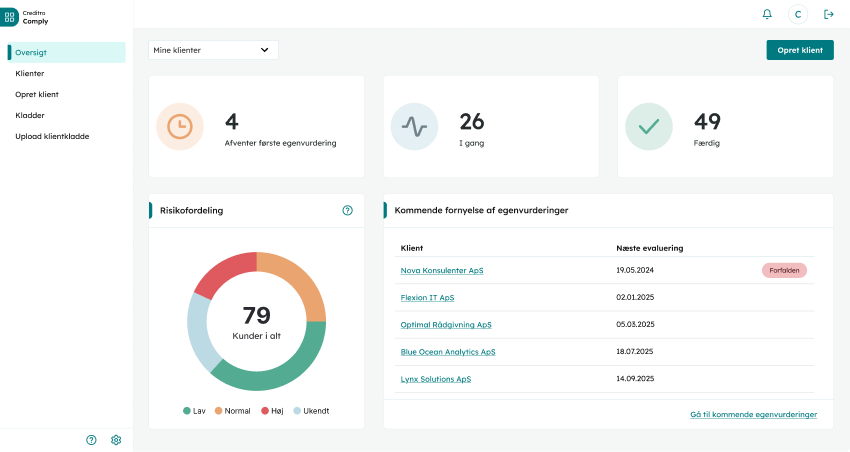

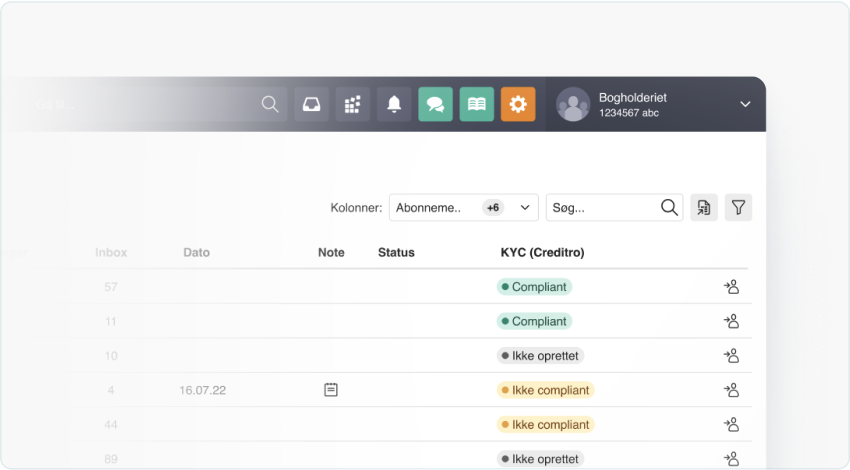

Complete overview for efficient workflows

Our platform is ideal for collaboration, if you wish to split the case work – for example between auditor and secretary. From client creation, to making your final assessment, everyone has access to all information.

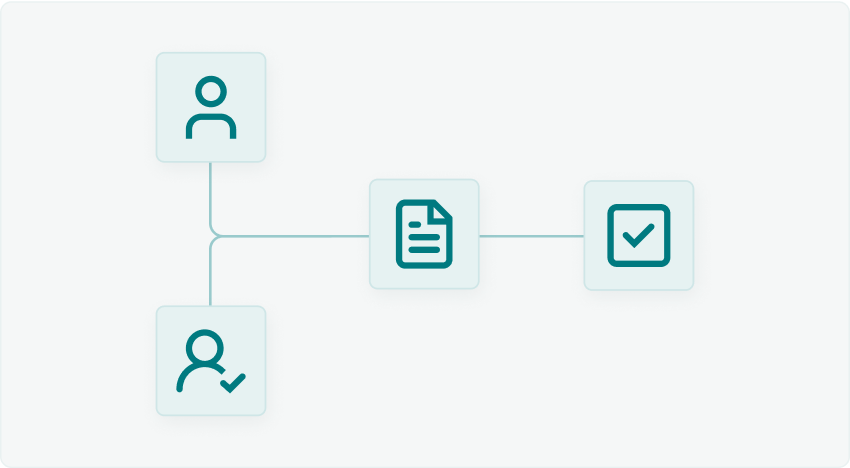

Questionnaires are adapted to your procedures

Our standard setup can be customised to match your client types and way of working. This makes your data collection more efficient and means you don't have to deal with a lot of new processes in your compliance work.

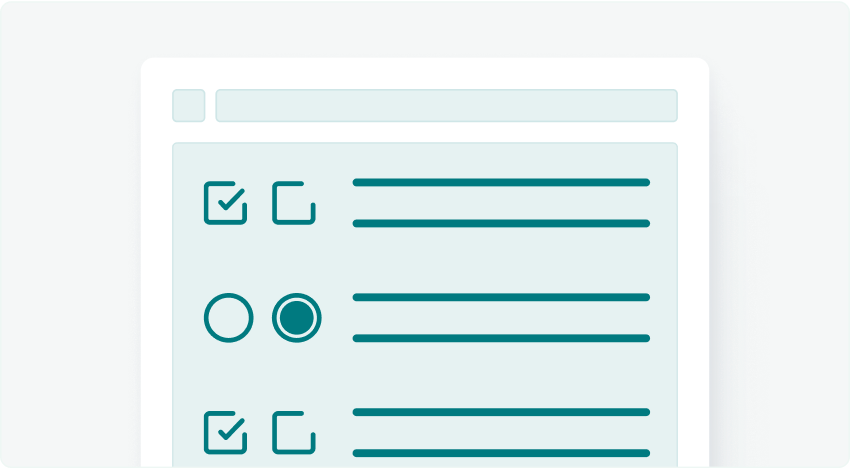

Comprehensive insights into your customers

You can easily see the entire company structure of your clients, including overview of the management, ownership structure and the beneficial owners. Making it simple to verify you clients' information.

Integration with e-conomic

KYC overview in your accounting platform

You can view your customers KYC status on your e-conomic platform, so you have all their information gathered in one spot.

Partnerships

in your industry

Creditro Consultancy

Customised consulting, that helps with your documentation

Understanding the legislation thoroughly is essential to fully address AML compliance. With our guidance, the best processes for your company are established, ensuring your documentation package is completely in order.

Support & Client Management

All the help you need, in one spot

We prioritise providing excellent support and take pride in the relationships we have built with our clients. Our extensive experience ensures that we are keenly aware of your specific needs and challenges.

Personal onboarding & advice

Get started with a Client Partner, who helps you setup and adapt the platform.

Technical support

We are standing by the phones and can help you with all kinds of questions.

SPARRING FOR AUDITS

In case of a notice or injunction, we can evaluate together and adapt your processes.

Creditro’s suite of software tools is your easy button for AML compliance

Creditro is here

to make your life easier

I highly recommend Creditro, if you are a law firm who is looking for an effective and reassuring system to manage AML compliance.

Head of KYC Compliance, Njord Law Firm

We have made a lot of improvements in our compliance work. A bonus is, the great credit reports on our customers that we can use internally.

Accountant/Director, ADMK

Let us simplify

your AML compliance

Compliance is tedious, but necessary. We help you through the tricky landscape in a simple and effective way, so you have time for other valuable tasks..