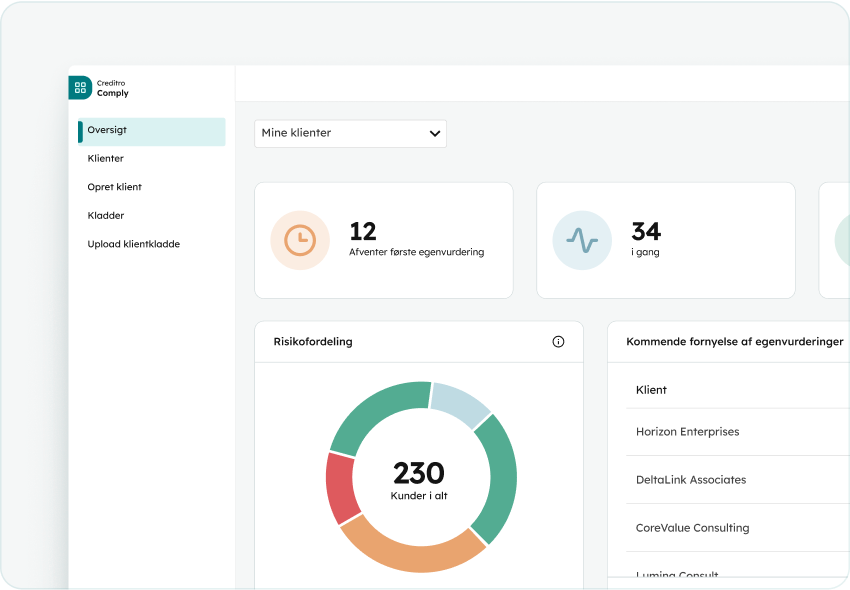

Creditro Comply

Swap demanding and manual KYC procedures with Creditro Comply

Collecting, verifying and following-up on KYC information, consumes a lot of your time. With Creditro Comply, you simply set the parameters that fit your workflows and let the system handle the work for you.

Creditro Consultancy

Customised consulting, that helps with your documentation

Understanding the legislation thoroughly is essential to fully address AML compliance. With our guidance, the best processes for your company are established, ensuring your documentation package is completely in order.

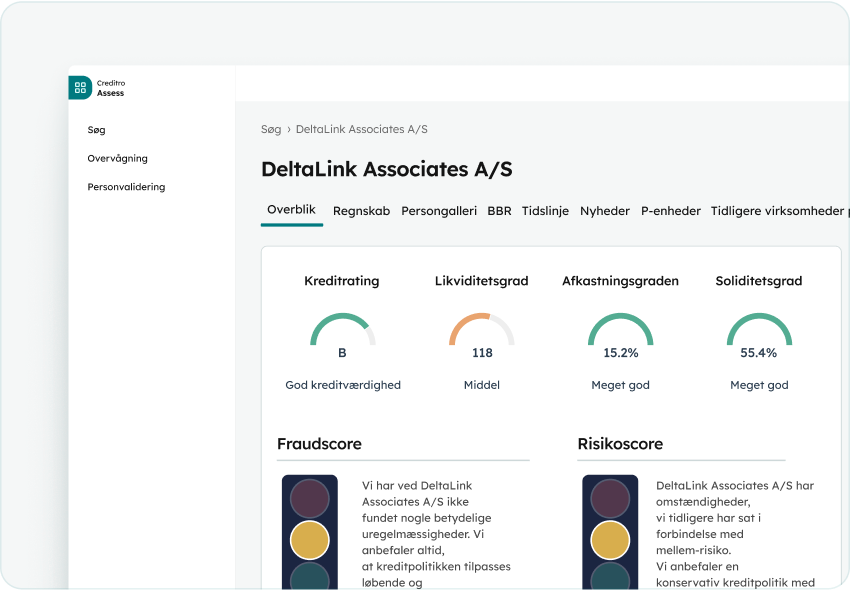

Creditro Assess

Minimise financial risks with automated credit assessments

Instant and precise credit assessments help you make informed decisions, so you avoid unnecessary risks and wasted work hours.

+1200 companies automate KYC process with Creditro

Put compliance in

our hands

With Creditro as your software partner for AML compliance, it’s easy to keep track of all your documentation. We automate your processes, so you can say goodbye to handheld workflows and say hello to simplified AML compliance.

.png?width=243&height=450&name=grib%20illustration%20(1).png)