Stop juggling KYC, risk assessments and paperwork

Save hours of manual work on client due diligence and stay audit-ready with a platform that automates your KYC process

Stop juggling KYC, risk assessments and paperwork

Save hours of manual work on client due diligence and stay audit-ready with a platform that automates your KYC process

+1200 companies automate their KYC with Creditro

Say hi to simplified AML compliance

Comply

with the law

The AML act leaves you with a long to-do list, which Creditros platform helps you organise and automate.

Say goodbye

to manual work

Automate your AML compliance, by adjusting the platform to your business needs.

Focus on your

core business

Time is valuable — don’t spend it on paperwork and documentation. Creditro will handle it for you.

Built for your industry

Creditro is designed around real-world AML workflows, so you get the ideal compliance setup.

Med Creditros værktøjer

er hvidvask compliance bare ét tryk væk

Creditro Comply

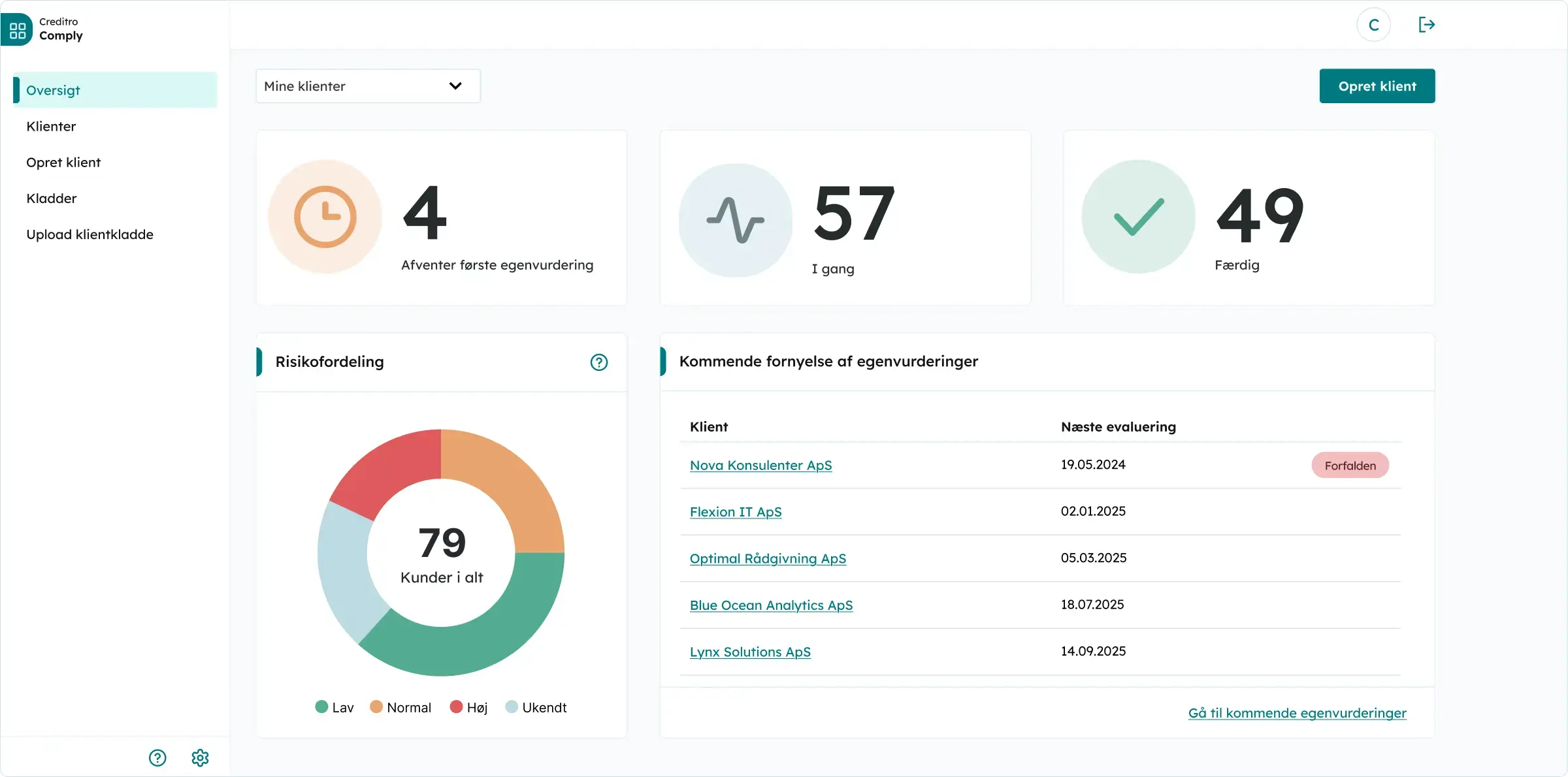

Replace manual work with Creditro Comply

Collecting information, verifying customers, and documenting everything takes up valuable time. With Creditro Comply, you set up workflows that fit your business and let the system do the work for you.

![]() Creditro Comply Light

Creditro Comply Light

A lightweight solution for a specific compliance need

Comply Light is built for law firms that need to securely collect and store client ID documentation for their client accounts. Get reliable compliance, without added complexity.

Creditro Assess

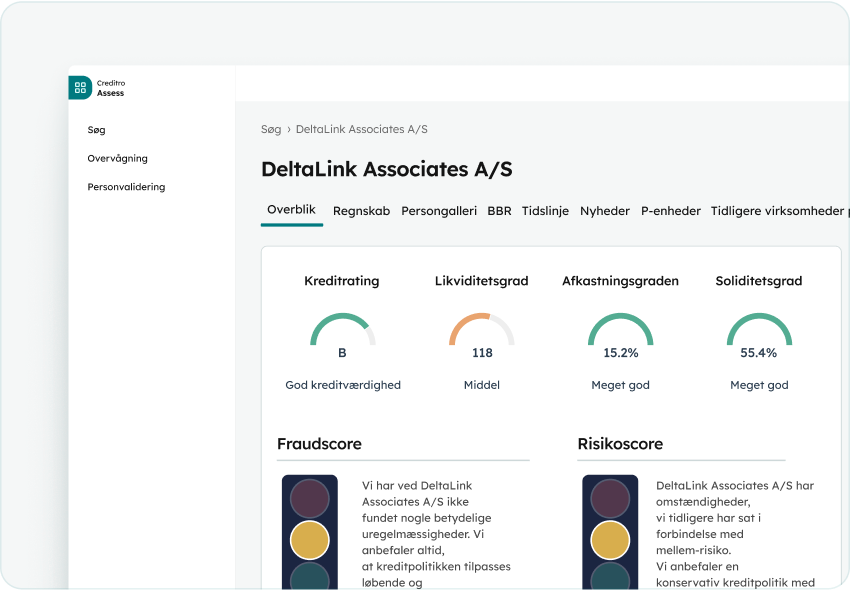

Reduce financial risk with automated credit assessments

Instant, accurate credit evaluations help you make informed decisions, making sure you avoid unnecessary risk and save valuable time.

Creditro Consultancy

Expert guidance to complete your compliance documentation

AML compliance requires deep regulatory insight to cover every requirement, and to make sure it is correctly documented. We help you build the right processes and ensure your documentation is fully in place.

Not sure what solution is the best fit for you? Book a free demo with us.

Why customers choose Creditro

I highly recommend Creditro, if you are a law firm who is looking

for an effective and reassuring system to manage AML

compliance.

Head of Compliance, Njord Law Firm

We have made significant improvements in our compliance, and we have also received some really cool credit reports on our customers for internal use, which is an added bonus.

Accountant/CEO, ADMK

Active users

Monthly KYC checks

Customers

See your potential savings

How much could you save by automating your manual workflows with Creditro Comply?

Get a quick estimate with our calculator!

We take your onboarding

and security seriously

All the help you need, in one place

We’re proud of the close relationships we’ve built with our customers. With deep experience in compliance, we understand your needs and help you every step of the way.

You can trust us

We take security seriously, because we know that sharing personal data requires confidence. That’s why we obtain an annual ISAE 3000 certification, confirming that personal data is handled in full compliance with GDPR.

Keep up with Creditro

Creditro er til for at gøre

dit arbejdsliv meget lettere

5 minutters læsetid

How to choose the right KYC solution for your business

Feb 27, 2026 by Jannie Andersen

3 minutters læsetid

The gut feeling: an important tool in compliance

Feb 11, 2026 by Jannie Andersen